Planning a family trip is exciting, but have you thought about what will protect you if things don’t go as planned? Choosing the best travel insurance for families isn’t just smart—it’s essential.

Imagine having peace of mind knowing your loved ones are covered, no matter what surprises come your way. In this guide, you’ll discover how to find the perfect insurance that fits your family’s needs and keeps you safe, so you can focus on making unforgettable memories together.

Keep reading to make your next trip worry-free.

Why Families Need Travel Insurance

Traveling with family brings joy and new experiences. But it also comes with risks. Illness, accidents, or lost luggage can happen anytime. Families need travel insurance to protect against these common problems.

Common family travel risksinclude:

- Health emergencies, especially for children and elderly members

- Trip cancellations or delays due to unforeseen events

- Lost or stolen belongings affecting the whole family

- Accidents during activities or transportation

Benefits of family coverage:

- One plan covers all family members, saving money

- Peace of mind knowing everyone is protected

- Easy claims process for multiple travelers

- Coverage for medical, trip, and baggage issues

Types Of Travel Insurance For Families

Families can choose from several travel insurance types, including trip cancellation, medical coverage, and emergency evacuation. Each plan offers specific benefits tailored to protect all family members during trips. Selecting the right coverage ensures peace of mind and safety for every traveler.

Single Trip Vs Annual Plans

Single trip plans cover one holiday. Great for short vacations. Annual plans cover many trips in a year. They are perfect for frequent travelers. Choose based on how often your family travels.

Medical And Emergency Coverage

Medical coverage helps when family members get sick. It covers doctor visits and medicine. Emergency coverage helps in urgent situations. This includes hospital stays and quick travel back home.

Trip Cancellation And Interruption

Sometimes trips get canceled. Trip cancellation coverage helps recover costs. It covers flights, hotels, and activities. Trip interruption covers unexpected returns home. It protects your travel investment.

Top Features To Look For

Coverage limitsshow the maximum amount insurance will pay. Check for medical expenses, trip cancellations, and lost luggage. Some policies exclude certain activities like adventure sports. Understand what is not covered to avoid surprises.

Look for family-friendly perkslike coverage for children under 18at no extra cost. Some plans offer free babysitting, travel assistance, and emergency childcare. Discounts for multiple family members can save money.

The claims processshould be simple and fast. Choose providers with 24/7 supportand clear instructions. Online claim filing and quick payouts reduce stress during travel emergencies.

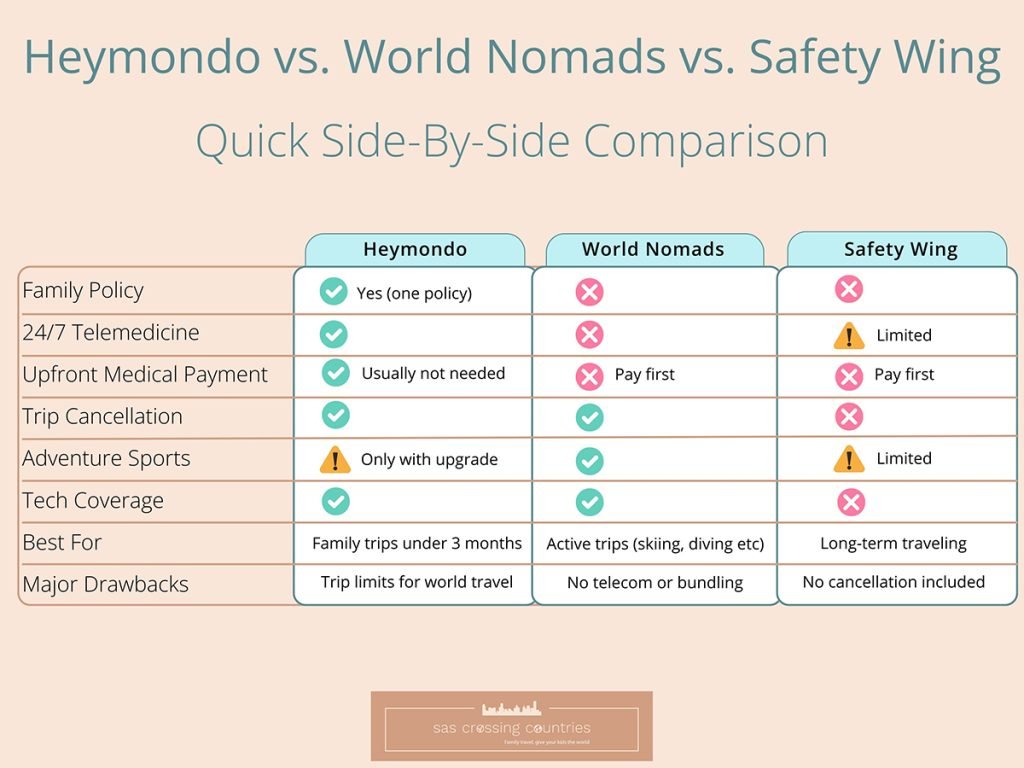

Credit: www.sascrossingcountries.com

Best Travel Insurance Providers For Families

Highly rated insurersoffer strong support and quick claims. Families trust them for reliable service and clear policies. These companies cover medical emergencies, trip cancellations, and lost baggage.

Affordable optionsfit many family budgets. They provide essential coverage without high costs. Look for plans that balance price and protection. Discounts often apply for multiple travelers.

Specialized family plansfocus on the unique needs of parents and children. They include extra benefits like coverage for kids’ activities and child care during emergencies. These plans simplify travel safety for families.

How To Choose The Right Policy

Think about what your family really needs. Consider ages, health, and activities planned. Travel with kids needs extra protectionfor accidents and illnesses. Check if the policy covers medical expenses, trip cancellations, and lost luggage. Some plans also cover emergency evacuationwhich can be very important.

Compare different insurance quotes carefully. Look at coverage limits, deductibles, and exclusions. Read customer reviews to see real experiences. Choose a policy that gives the best value, not just the lowest price. Remember, cheaper might mean less protection.

- Buy insurance early for better rates.

- Check if pre-existing conditions are covered.

- Make sure all family members are included.

- Keep copies of your policy during travel.

- Ask about adding extra coverage if needed.

Credit: www.nerdwallet.com

Saving Money On Family Travel Insurance

Discounts and bundlescan lower family travel insurance costs. Many companies offer special rates for families. Buying insurance for all members in one plan often saves money. Some insurers give discounts for multiple trips or long trips.

Credit card benefitssometimes include travel insurance. Check if your card covers trip cancellations or emergencies. Using these benefits can reduce the need to buy extra insurance. Always read the terms carefully to know what is covered.

Avoiding unnecessary coveragehelps keep costs down. Families often pay for extras they do not need. Skip coverage for activities or items not planned for your trip. Only choose the protection that matches your family’s needs.

Credit: www.remitbee.com

Frequently Asked Questions

What Does Family Travel Insurance Typically Cover?

Family travel insurance covers medical emergencies, trip cancellations, lost luggage, and travel delays. It protects all family members under one plan, ensuring financial security during unforeseen travel events. Coverage may also include adventure activities and pre-existing medical conditions depending on the policy.

How To Choose The Best Travel Insurance For Families?

Look for comprehensive coverage, affordable premiums, and flexible policy options. Ensure the plan covers children and offers emergency medical and trip cancellation benefits. Compare multiple insurers’ reviews and policies to find the best fit for your family’s travel needs.

Are There Specific Travel Insurance Plans For Families?

Yes, many insurers offer family travel insurance plans. These plans combine coverage for all family members, often at a discounted rate. They simplify management and provide broad protection, making them ideal for family vacations or extended trips.

Can Travel Insurance Cover Pre-existing Medical Conditions?

Some family travel insurance policies cover pre-existing medical conditions if declared upfront. Coverage depends on the insurer and policy terms. Always read the fine print and disclose all health conditions to avoid claim denial during your trip.

Conclusion

Choosing the right travel insurance keeps your family safe and stress-free. It covers medical help, trip delays, and lost luggage. Read all policy details carefully before buying. Compare prices and benefits to find the best fit. A good plan protects your loved ones during travel.

Peace of mind makes every trip more enjoyable. Travel smart, travel safe.