Are you planning to dive into thrilling adventure sports on your next trip? Whether you’re skiing down snowy slopes, rock climbing steep cliffs, or surfing powerful waves, your adrenaline rush comes with risks.

That’s where the right travel insurance steps in—it’s not just a safety net but your peace of mind when every moment counts. Choosing the best travel insurance for adventure sports can protect you from unexpected costs and keep you focused on the excitement ahead.

Ready to find the perfect coverage tailored to your daring spirit? Keep reading to discover what you need to stay safe and confident during your adventures.

Why Adventure Sports Require Special Insurance

Adventure sportscome with higher risks than regular activities. Injuries can be serious and costly. Regular insurance often does not cover these risks. Special insurance offers protection for accidents during sports like skydiving, rock climbing, or scuba diving.

Such insurance covers:

- Medical treatment costs

- Emergency evacuation

- Trip cancellations due to injury

- Damage to rented sports gear

Choosing insurance made for adventure sports ensures you get proper help fast. It gives peace of mind while enjoying thrilling activities.

Credit: www.squaremouth.com

Key Features To Look For In A Policy

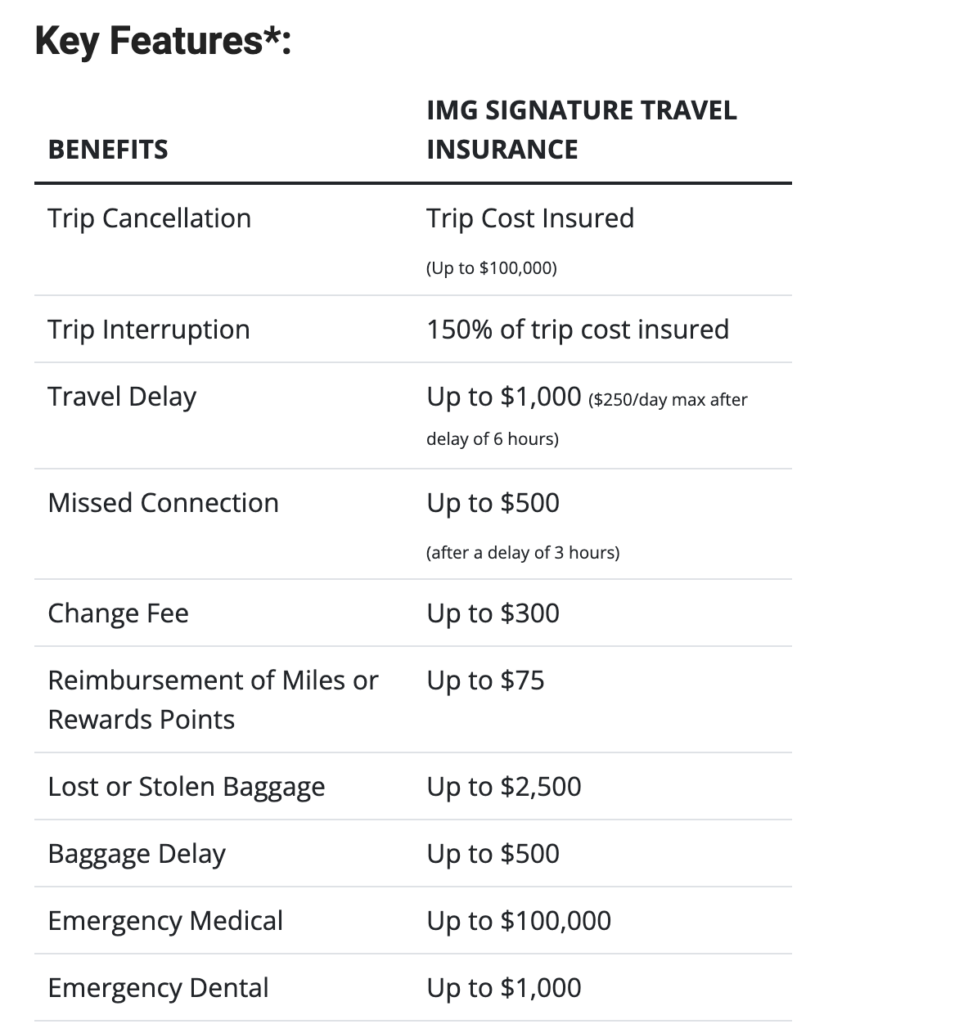

A good travel insurance policy covers medical emergencies and equipment loss during adventure sports. It should also include trip cancellations and rescue expenses for full protection.

Coverage For Medical Emergencies

Medical coveragemust include accidents and injuries during adventure sports. It should cover hospital stays, surgeries, and doctor fees. This ensures quick helpwithout heavy bills.

Evacuation And Repatriation

In case of serious injury, evacuationto a safe hospital is vital. Policies should cover transport costsback home if needed. This keeps travelers safe far from home.

Gear And Equipment Protection

- Protection for sports gearis important. It covers damage or loss.

- Check if equipment repair or replacementis included.

- High-value items may need extra coverage.

Trip Cancellation And Interruption

Plans should refund if trips end early or get canceled. This covers non-refundable costslike flights or bookings. Helps avoid losing money due to unexpected events.

Top Insurance Providers For Adventure Sports

Adventure sports need special travel insurance for safety and peace of mind. Top providers offer coverage for activities like skiing, hiking, and scuba diving. Choose plans that cover accidents, medical help, and trip cancellations.

Comprehensive Coverage Plans

Comprehensive plans cover injuries, equipment loss, and trip cancellations. They often include medical expenses, rescue costs, and liability protection. These plans offer peace of mind for various adventure activities.

Budget-friendly Options

- Lower premiums with basic coverage

- Suitable for occasional adventurers

- May exclude extreme sports risks

- Good balance between cost and protection

Specialized Providers For Extreme Sports

These providers focus on high-risk activities like skydiving and rock climbing. They offer tailored coverage for injuries and gear damage. Ideal for serious thrill-seekers needing specific protection.

Comparing Policies: What To Consider

Policy limitsdefine the maximum amount an insurer will pay. Check for coverage capson medical expenses and accidents. Some policies exclude certain activities like skydiving or scuba diving. Read exclusions carefully to avoid surprises.

The claim processshould be simple and fast. Look for companies with 24/7 customer support. Clear instructions and quick responses help in emergencies.

| Factor | What to Check |

|---|---|

| Premium Costs | Compare prices for similar coverage. Cheaper isn’t always better. |

| Deductibles | Higher deductibles lower premiums but mean more out-of-pocket costs. |

Tips For Choosing The Right Plan

Assess how risky your adventure activities are. Different sports have different dangers. Choose a plan that covers the specific risks you face. Think about how often you do these activities and where.

Reading customer reviews helps find reliable plans. Look for feedback on claim processes and coverage. Pay attention to what others say about customer service and response times. Real user experiences can guide your choice.

Consult insurance experts to understand plan details. They can explain what is covered and what is not. Experts help you find the best value for your needs. Ask questions about limits, exclusions, and emergency support.

Credit: www.squaremouth.com

Common Mistakes To Avoid

Underestimating coverage needscan leave you unprotected during emergencies. Adventure sports often have higher risks, so standard plans might not cover all activities.

Many travelers ignore policy exclusions. Some insurance policies exclude certain sports or conditions. Always check what is not covered to avoid surprises later.

Failing to notice adventure-specific clausesis common. These clauses may limit coverage or add extra costs. Reading the fine print helps prevent unexpected costs.

- Check if your sport is covered.

- Understand limits on medical expenses.

- Note any activity restrictions.

- Confirm if rescue or evacuation is included.

Credit: epicexpeditions.co

Frequently Asked Questions

What Is The Best Travel Insurance For Adventure Sports?

The best travel insurance for adventure sports covers injuries, equipment loss, and emergency evacuations. Look for policies with high medical limits and specific adventure sports coverage. Compare plans based on your sport type and trip duration for optimal protection.

Does Travel Insurance Cover Extreme Sports Accidents?

Yes, some travel insurance policies cover extreme sports accidents. Ensure your plan explicitly includes your sport, like skydiving or rock climbing. Without specific coverage, claims may be denied. Always verify the policy’s adventure sports clause before purchasing.

How To Choose Travel Insurance For Adventure Activities?

Choose travel insurance by checking coverage for medical emergencies, trip cancellations, and equipment. Confirm it covers your specific adventure sport. Read policy exclusions carefully. Opt for providers with good reviews and 24/7 emergency support.

Are Pre-existing Conditions Covered In Adventure Sports Insurance?

Pre-existing conditions are usually excluded or require additional premiums. Some insurers may cover them with disclosure. Always declare your health conditions honestly to avoid claim rejection. Review policy terms for clarity on pre-existing condition coverage.

Conclusion

Choosing the right travel insurance keeps your adventure safe and worry-free. It protects you from unexpected costs and risks during sports activities. Always check what the policy covers before buying. Think about your sport type, trip length, and health needs.

Good insurance lets you enjoy your adventure with peace of mind. Stay smart, stay safe, and make your trip memorable.